In digital transformations, the digital customer onboarding process is gaining significant attention, especially in industries like banking and insurance, where traditional paperwork still lingers. While e-commerce has streamlined the online buying experience, many sectors need help to match this efficiency.

The urgency is magnified as today’s consumers, particularly the tech-savvy Millennial segment, quickly switch loyalties. They demand a seamless, quick onboarding experience similar to their retail interactions.

Unfortunately, slow, paper-based onboarding processes persist in various organizations, leading to resource-intensive operations, low customer approval, and substantial dropout rates.

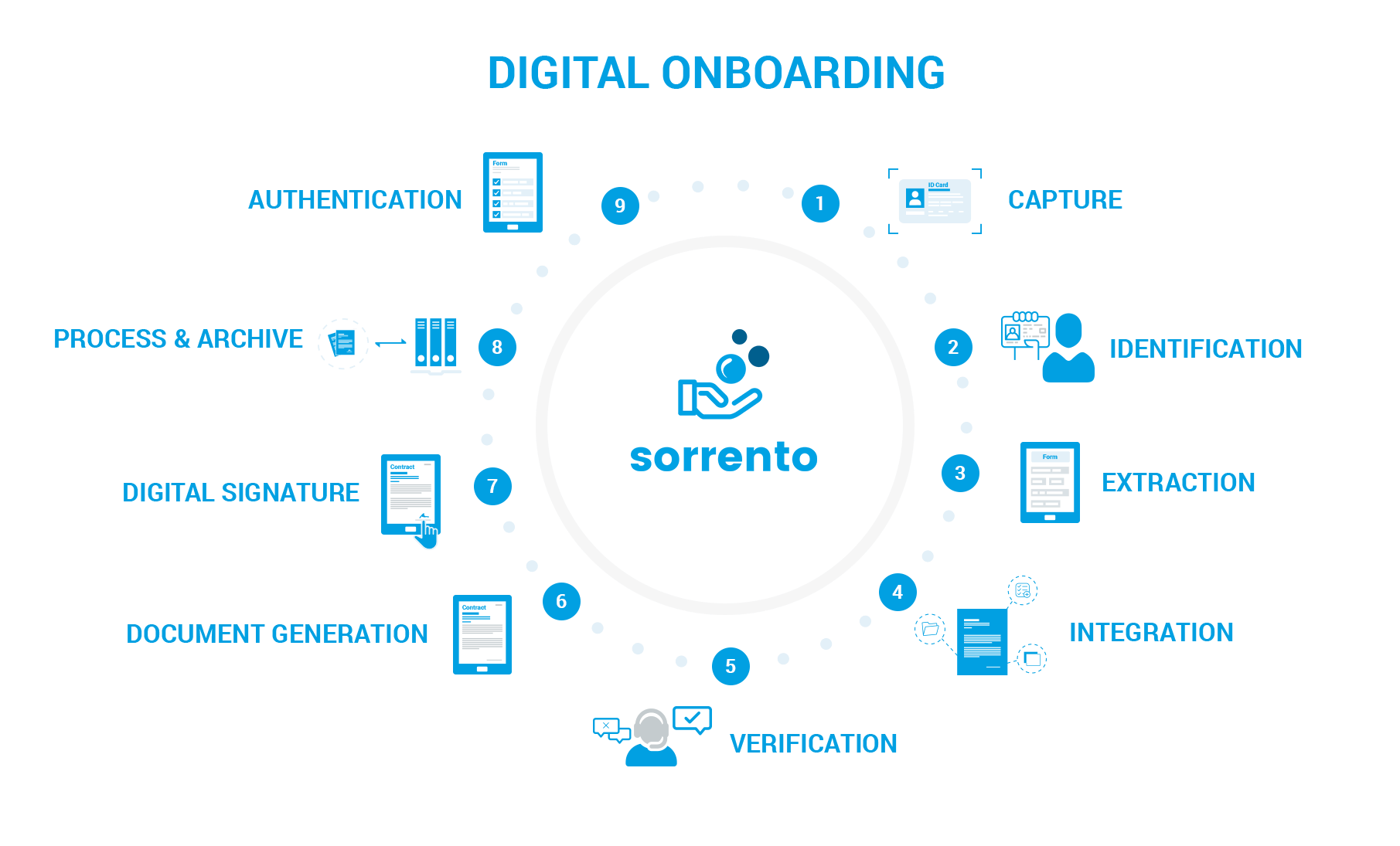

To address this challenge, organisations must undergo a crucial transformation towards agile and automated customer/vendor interactions. The digital onboarding solution becomes pivotal, and key elements include efficient capture, identification, extraction, integration, verification, document generation, digital signature, process and archive, and authentication.

While off-the-shelf and custom-made solutions exist, the true advantage lies in the holistic integration of these steps, ensuring a user-friendly front end and a fluid and automated back end.

Understanding the Digital Customer Onboarding Process

The digital customer onboarding process is how businesses validate new customer information, authenticate new customers, and integrate them into their systems. As all businesses should comply with regulatory concepts, this onboarding process is the same for banking, telecom, governmental sectors, or any other type of business or organisation.

It involves collecting customer information such as name, address, and identification details, accepting any terms and conditions, and verifying financial information in the case of KYC.

One potential benefit of the digital onboarding process is its convenience. Customers can easily submit information anywhere, anytime, using their mobile devices or computers.

This creates a more seamless, hassle-free experience for the customer, allowing businesses to establish and maintain compliance with various regulations, such as Know Your Customer (KYC) and Anti-Money Laundering (AML).

The Role of Digital Signature in the Customer Onboarding Process

A digital signature is essential to the onboarding process, enabling users to sign legally binding documents electronically. Electronic signatures offer several advantages over traditional paper-based signatures, including improved document tracking and faster processing times.

Moreover, e-signatures can reduce errors, mitigate fraud, and enable businesses to meet regulatory requirements if they are stored with a supplier who offers qualified electronic archiving.

User Onboarding Authentication

Authentication is the process of verifying a user’s identity. Online businesses typically use various identity verification techniques to authenticate new users, including passwords, two-factor authentication, biometrics, and others.

User onboarding authentication is vital because it helps protect businesses from identity theft, fraud, and other fraudulent activity.

Onboarding Process Flow Chart

Here, we outline a comprehensive nine-step approach for a successful digital onboarding process, catering to both visible customer-facing aspects and equally crucial backend operations. These steps encompass;

1. Capture

- Definition: The initial step involves the acquisition of diverse documents, such as identification cards, utility bills, or other relevant forms, through various channels.

- Process Overview: The capture process utilizes advanced scanning technologies to ensure the digitization of physical and digital documents, laying the groundwork for subsequent stages.

2. Identification

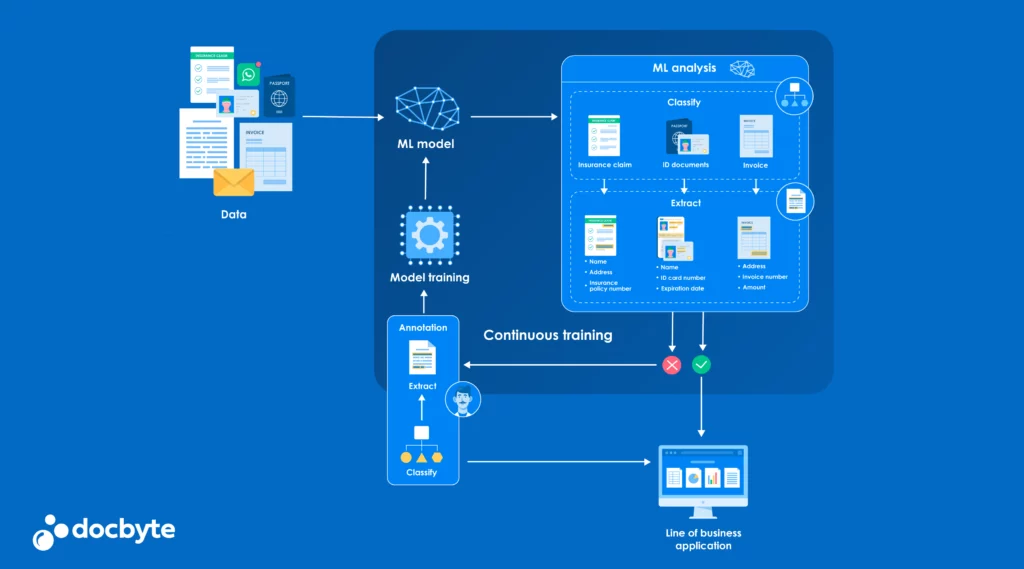

- Definition: Once documents are captured, the identification step employs Optical Character Recognition (OCR) and intelligent algorithms to recognise and categorise the relevant information within each document.

- Process Overview: This stage involves extracting key data points like names, addresses, and identification numbers, forming the basis for the subsequent verification process.

3. Extraction

- Definition: Building on the identified data, the extraction step involves isolating and extracting specific information required for the onboarding process.

- Process Overview: Specialized algorithms analyse the document content, extracting relevant details such as addresses, phone numbers, financial information, or any other pertinent data crucial for customer identification.

4. Integration

- Definition: Integration entails incorporating the extracted data seamlessly into existing systems, ensuring a unified and coherent repository of customer information.

- Process Overview: The integration process connects the onboarding system with internal databases, Customer Relationship Management (CRM) systems, or other relevant platforms, fostering data consistency and accessibility.

5. Verification

- Definition: Verification is a critical step to validate the accuracy and authenticity of the extracted information, ensuring it aligns with predefined criteria and compliance standards.

- Process Overview: Robust verification processes are facilitated by automated checks, cross-referencing against external databases, and adherence to Know Your Customer (KYC) guidelines.

6. Document Generation

- Definition: After successful verification, the document generation step involves creating necessary agreements, contracts, or any essential paperwork required for the customer onboarding process.

- Process Overview: Automated tools generate customised documents based on verified customer information, streamlining the paperwork necessary to formalise the onboarding process.

7. Digital Signature

- Definition: In the digital signature step, the onboarding documents are presented for electronic signatures, allowing customers to securely endorse and authenticate their information.

- Process Overview: Leveraging advanced cryptographic techniques, digital signatures ensure the integrity and authenticity of the signed documents, eliminating the need for physical signatures.

8. Process & Archive

- Definition: This step involves orchestrating the onboarding process, guiding the flow of information through predefined workflows, and archiving the finalised documents for future reference.

- Process Overview: Automated workflows manage the sequential progression of onboarding tasks, ensuring a systematic and auditable process. The archival process securely stores all relevant documents for compliance and record-keeping purposes.

9. Authentication

- Definition: The final step focuses on authenticating the newly onboarded customer, granting access to relevant services, and ensuring a secure and seamless transition into the established customer ecosystem.

- Process Overview: Multi-factor authentication methods, such as biometrics or secure access codes, enhance the security of customer access and safeguard sensitive information throughout their journey with the organisation.

Tips for Enhancing the Digital Customer Onboarding Experience

An effective digital onboarding process has several key characteristics: simplicity, customer-centricity, security, and speed. To enhance your digital onboarding process, consider integrating automated workflows, ensuring seamless document approval processes, and reducing the number of manual touchpoints.

Additionally, businesses should ensure that they collect only the necessary data from the customer and provide clear guidance throughout the onboarding process.

By embracing this holistic approach, organisations can enhance the customer experience, achieve higher conversion rates, and establish communication standards that foster lasting relationships.

As digital becomes the new normal, organisations must recognise that customers can decide where to place their trust. The future demands full integration and seamless functionality to satisfy customers and prevent them from seeking alternatives. It’s time for all of us to smarten up to the new normal of digital excellence.