- +32 9 242 87 30

- info@docbyte.com

- Kortrijksesteenweg 1144 B 9051 Gent

- +32 9 242 87 30

- info@docbyte.com

- Kortrijksesteenweg 1144 B 9051 Gent

Optimize your onboarding process with

our innovative digital onboarding solution

for a seamless and secure customer journey.

Effortless digital onboarding - quick,

easy, seamless.

Eliminate paper from the process, both externally and internally.

Preservation digital signature, preservation digital seals & all information.

Automate the onboarding process for customers as much as possible.

Reduce your operational costs by 60%.

Increase your sales by 200%.

We collect and perform

document verification efficiently

and securely.

Automated workflow ensures

error-free document generation

and reliable screenings.

We transform your customer data verification process into an intuitive, secure and efficient process with our advanced digital solution, significantly reducing manual checks, enhancing customer experience, and accelerating decision-making.

With automatic document checks and data extraction, we're giving your customer onboarding the speed it needs.

We've created an easy-to-use, custom-branded portal to give your customers a welcoming and personalized experience.

Our sturdy fraud prevention measures will reassure your customers that they're in safe hands.

We’re offering your customers the freedom to onboard from any device. It’s about being flexible for your customers' comfort.

Make informed decisions faster with our automated data extraction, simplifying your decision-making process.

Our solution plays nice with your existing systems. It’s about enhancing your setup, not complicating it.

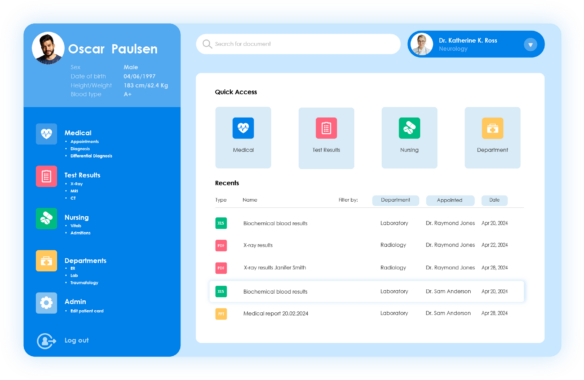

Personalize your customer's journey with our upload portal, customized to match your corporate style. It allows file uploads and picture-taking, offering flexibility to your customers.

We streamline the onboarding process with automatic checks to data including digital signature verification to ensure the correct type of documents are received, reducing errors and speeding up the process.

With automatic data extraction and rule

application, you can accelerate decision-making and enhance data accuracy.

Leverage advanced cross-checks between different documents like digital signature validation to enhance your fraud prevention measures.

Our platform is designed as a progressive web app, allowing sessions to be seamlessly transferred between mobile and desktop devices.

At Docbyte, we focus on simplifying your customer onboarding and managing

lending processes through intelligent document processing. Our system caters to mortgages, leasing contracts, and more,

promising efficient operations.

Our solution reduces customer acquisition time from days to hours, making the process swift and secure.

We cater to all scenarios: Point of Sales, Mobile Salesperson, and home processes. Choose between fully digital or semi-digital options as per your needs.

Our Automated Document Collection makes document management effortless, simplifying requests and extraction of necessary data.

Stay updated on all your ongoing and completed onboarding processes with our back-end system. Human intervention is made easy, especially for Risk Assessments or Compliance checks.

We auto-generate necessary documents and contracts for easy digital signing.

Integrate our solution with various data sources to extract and analyze data, making the loan origination process more efficient.

We merge customer onboarding with loan applications to streamline the process and minimize customer touchpoints.

Our solution has been implemented in various scenarios including Mortgage Applications, Consumer Credit, Car Leasing, and eCommerce, proving its effectiveness.

Trusted by Global Businesses Across all Industries

Request a short session with one of our intelligent document processing specialists and find out which solution works best for you.