As banking technology advances, financial institutions need to keep up with the regulations and requirements set by governing bodies, such as the European Central Bank (ECB). One such requirement is the permanent archiving of communication documents, which poses challenges due to constantly evolving technology.

Docbyte discusses how certain communication documents from banks should be permanently archived according to the ECB, and why archiving and long-term preservation software is essential for the banking industry.

Managing Banking Communication Documents with Software

Financial institutions can significantly benefit from utilising advanced financial document processing software and electronic archiving solutions to meet the European Central Bank’s (ECB) stringent requirements for permanently archiving crucial documents.

These technologies offer a streamlined approach to managing the diverse documents mandated by the ECB. Legal acts and supporting documentation, pivotal in legal disputes or audits, can be efficiently processed, indexed, and stored digitally, ensuring accessibility and compliance.

Financial document processing software enables the creation of comprehensive master sets of final products and deposit copies of publications, providing a detailed snapshot of the bank’s activities at specific points in time.

Moreover, the software facilitates the management of records inventories, guides, and schedules, ensuring proper maintenance and accessibility. Electronic archiving complements these efforts, offering a secure and centralized repository for these digital documents, adhering to the ECB’s guidelines for permanent archival.

By integrating these technologies, financial institutions can align with the ECB’s requirements, fostering efficiency, accuracy, and compliance in their document management processes.

However, the upsides of working with a financial document processing system go even further. Efficient onboarding and validation of identities are critical components of the financial services landscape.

It can cover key processes involved in identity verification when executing Know Your Customer (KYC) procedures. It also covers data sharing and consolidated databases on investors, aiming for a more streamlined and secure approach.

Document Collection & Customer Onboarding

Public access requests are another reason why permanent archiving is essential. Banks must be able to provide customers with information about their accounts and transactions upon request.

Having these documents archived permanently can simplify the process. However, we’ll mainly focus on the document processes of onboarding identities in financial institutions.

Onboarding and Validation of Identities

The onboarding and validation of identities in financial services are typically carried out by dealers or issuer agents, depending on the issuance form. The responsibility for executing KYC procedures lies with the financial service provider, such as a bank; although outsourcing to third parties is allowed, the ultimate responsibility remains with the provider.

Basic customer due diligence involves recording relevant data on customer identity and verifying that information. It’s important to note that the European Commission is currently reconsidering kyc rules as part of its Digital Finance package, drawing lessons from the COVID-19 lockdown experiences.

Data Sharing and Consolidated Databases on Investors

Dealers/agents currently play a crucial role in offering KYC services to investors, and there’s a vision of creating a “certified database” fed by dealers through an onboarding and KYC procedure for both investors and issuers.

This database could streamline various issuance mechanisms, such as auctions and syndications, facilitating smoother handling of allocated orders and enhancing the issuer’s client knowledge.

Issuers recognize the need to maintain up-to-date data on their investors, both concerning investor bids in a transaction and on an ongoing basis. Established customer relationships obviate the need for redundant identification processes; however, routine updates and maintenance are imperative, especially in response to changes in identifying elements such as address or legal name.

The customer identity verification process aligns with the EU Anti-Money Laundering (AML) directive and complies with national regulations. The specific methods and documents involved include:

For Natural Persons

– Checking national identity cards

– Verifying passports, resident permits, qualified e-IDs, etc.

– Name

– Address

– Place and date of birth

– Nationality

For Companies

– Requesting a certificate of public registration, such as a commercial register or partnership agreement

– Identifying partners

– Verifying qualified e-IDs and other relevant documents

– Company details

– Trading name

– Legal form

– Commercial register number

– The address of its registered office or head office

– Names of its representative body or legal representative

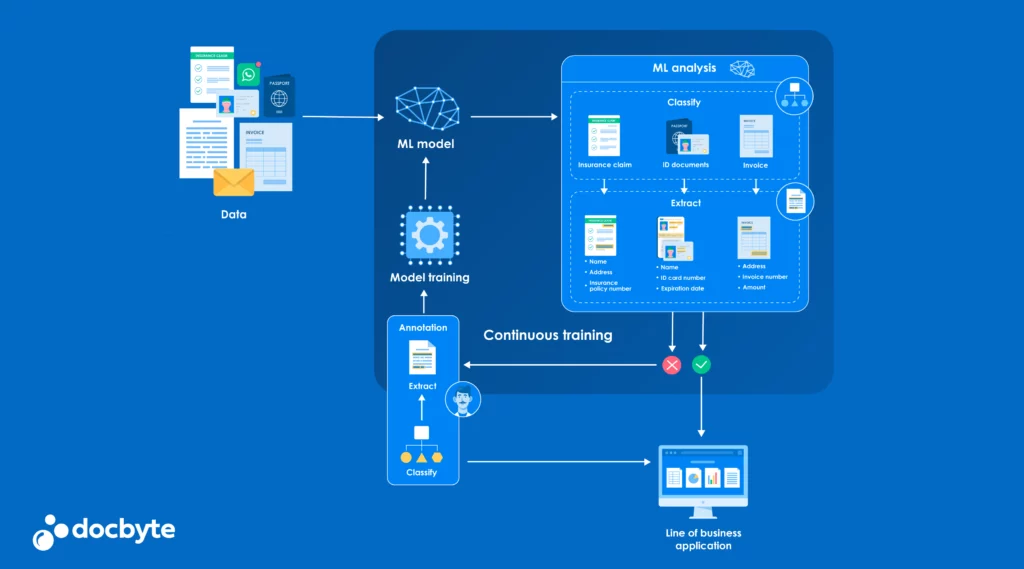

As mentioned, the dealer or issuer agent is responsible for storing and maintaining customer data. So, financial document processing enables you to reduce the repetitive tasks your customers have to do when providing sensitive data. Moreover, since the AI collects, you are saving your employees’ time, too.

In practice, your customers receive a request to upload a required document. Then it will automatically read and connect this document to the related customer’s case.

Anonymization for GDPR

Anonymization tools allow data to be read from collected documents while blacking out or blurring images that could reveal personal information, such as ID headshots. These tools provide immediate, real-time protection, ensuring that data is not accessed or copied while waiting in your folder.

Ensuring access control is also necessary to adhere to GDPR limitations. Investor passporting is one solution for ensuring user data is secured. It involves securely sharing data among different companies and regulatory bodies.

So, it does allow third-party solutions to access user data; however, they are also required to comply with data protection regulations. It creates harmony in the financial service sector, allowing data-sharing without risking user privacy.

How Financial Document Processing Is Making Banking Easier

Financial institutions increasingly use online document processing and electronic archiving to streamline operations and enhance efficiency. The benefits of embracing these technologies are profound, from eliminating paper-based processes to substantial cost reductions and increased sales.

Let’s highlight key advantages and practical applications for financial service providers.

1. Paperless Efficiency

With online document processing, financial institutions can bid farewell to cumbersome paper-based workflows externally and internally. The transition to digital platforms allows for seamless document handling, reducing the risk of errors and improving overall operational efficiency.

2. Preservation of Digital Signatures and Seals

The integration of the preservation of digital signatures and seals ensures the security and authenticity of critical information. This enhances data integrity and establishes a secure framework for compliance with regulatory requirements.

3. Automated Onboarding Processes

Leveraging technology, financial institutions can automate customer onboarding processes, expedite procedures, and minimize manual intervention. This enhances customer experience and facilitates compliance with KYC (Know Your Customer) procedures.

4. Operational Cost Reductions

One of the most significant advantages of adopting online document processing is the potential to reduce operational costs by a staggering 60%. Automation of workflows and document screenings leads to resource optimization and improved cost-effectiveness.

5. Efficient Document Verification

Adopting efficient and secure document verification processes ensures the accurate collection and processing of essential information. Automated workflows contribute to error-free document generation, enhancing the reliability of screenings.

6. Sales Boost

Financial institutions can experience increased sales by implementing streamlined onboarding and identity validation processes. This not only accelerates customer acquisition but also fosters long-term customer relationships.

7. KYC Procedures and Digital Finance

The European Commission is reevaluating KYC (Know Your Customer) rules within the Digital Finance package, considering lessons learned from COVID-19 lockdowns. Financial service providers are responsible for executing KYC procedures, and potential outsourcing to third parties is being explored.

8. Data Sharing and Consolidated Databases

A unified database for investor information emerges as a powerful tool for efficient syndication and direct access in auctions. Maintaining up-to-date data on investors is crucial for financial institutions, and the concept of a certified database fed through onboarding and KYC procedures is gaining traction.

Given the challenges of technology, long-term preservation software is critical for maintaining these archives. This software can help banks ensure their archived documents’ authenticity, accuracy, and completeness. It enables banks to manage the lifecycle of their records, including the creation, storage, and eventual disposal of certain documents.

Additionally, long-term preservation software protects against technological obsolescence by ensuring that documents can be migrated or converted to new formats as needed.