Intelligent Document Processing (IDP) is a type of technology that uses artificial intelligence (AI) to extract data from documents. This technology is becoming increasingly popular in the financial services industry, particularly in credit acceptance and loan processing. In this blog post, we’ll explore how IDP can help financial institutions and their customers in the European Union (EU), using our custom build solutions, tailored for your specific needs.

What is Intelligent Document Processing?

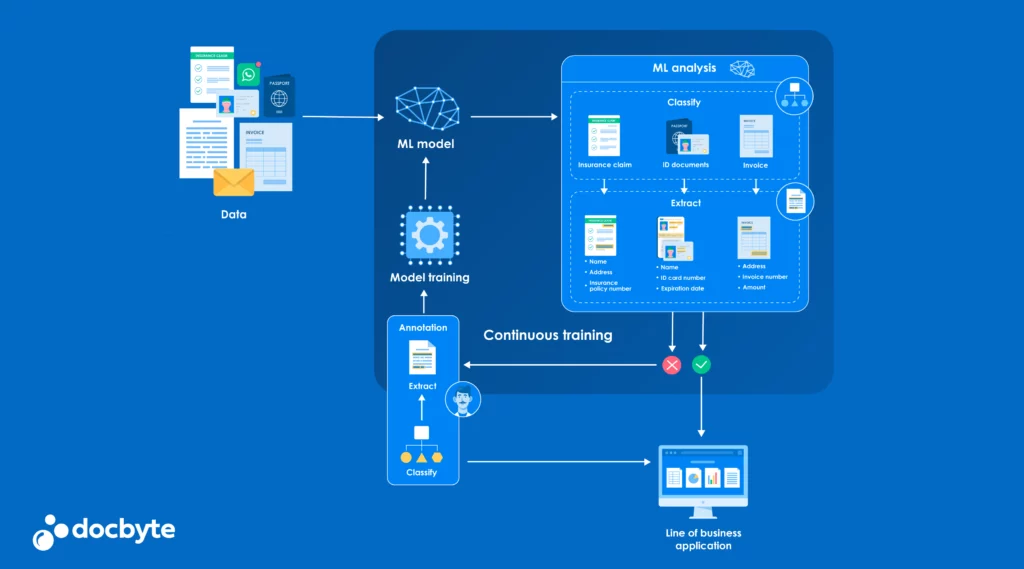

Before we dive into the benefits of IDP, let’s first define what it is. IDP uses AI and machine learning algorithms to extract data from unstructured documents, such as loan applications, invoices, and contracts. This technology can help automate the manual data entry process, which can save time and reduce errors.

How Can IDP Help in Credit Acceptance and Loan Processing?

Faster Processing Time

Increased Accuracy

Manual data entry can be prone to errors, which can lead to issues such as incorrect loan amounts, interest rates, and payment terms. IDP can help improve accuracy by extracting data directly from the source documents. This can help reduce errors and ensure that customers receive the correct loan amounts and terms.

Enhanced Customer Experience

Intelligent Document Processing can help improve the overall customer experience by reducing processing time and increasing accuracy. Customers can benefit from a streamlined loan application and approval process, which can help them obtain credit faster. Additionally, IDP can help reduce the likelihood of errors, which can help increase customer satisfaction.

Regulatory Compliance

Intelligent Document Processing is here to help financial institutions in the EU save up to 90% of the time spent on document processing. Additionally, IDP can help increase accuracy and have a significant impact on credit acceptance and loan processing, helping financial institutions process loan applications faster and more accurately.

In Conclusion

Intelligent Document Processing can provide several benefits to financial institutions and their customers in credit acceptance and loan processing. This technology can help streamline the loan application and approval process, increase accuracy, improve the customer experience, and ensure regulatory compliance. As the financial services industry continues to evolve, IDP will become an increasingly important technology for credit acceptance and loan processing.

If you are interested in finding out more about Docbyte solutions for Intelligent Document Processing here is a great case study from EDR Credit Services.

Feel free to contact us and find out more about our services.